how to calculate pre tax benefits

The formula for calculating pretax income is as follows. First subtract the 50 pre-tax withholding from the employees gross pay 1000.

Overtime Pay Laws Every Business Owner Needs To Know Bookkeeping Business Business Basics Accounting And Finance

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

. Pre-Tax financial income is just like it sounds - its the earnings a company generates before deducting the taxes it needs to pay. Subtract the value of your debt service from your NOI. This calculator provides calculations about the effect of pre-tax and post-tax contributions on your personal income tax.

Depending on your tax rate and other factors Lets take a look at three common categories of pre-tax benefits that employers offer. By offering employees a pre-tax commuter benefit program the cost of commuting deducted for employees reduces the amount of payroll being taxed. 1 Types of plans.

Click to follow the link and save it to your Favorites so you can use it again in the future without having to input your information again. 23000 is 6200 more than 16800. For instance on a Pre-EMI of Rs5 lakhs Rs 1 lakh will be depicted as tax deduction for the next 5 years.

There are two types of benefits deductions. The allure of a particular job is linked to the type and number of benefits your potential employer offers. Pre-tax deductions reduce the employees taxable income which can save them money when filing their federal income tax.

This means a savings of up to 765 on average on payroll taxes. If pretax deductions are counted as taxable wages subtract the benefit. To offer you pretax health insurance your employer must establish a plan that meets Section 125 of the Internal Revenue Code.

Health transportation and retirement. No other tax offsets have been taken into account. For example if you make 12 payments of 1400 over the course of the year that adds up to a debt service of 16800.

Lets start by defining a pre-tax benefit plan. 391000 - 101000 90000 1000 900 0 198100 Pretax Income. Additionally since they are not mandatory the decrease of taxable income comes along with the benefits of your choice.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. The money is pulled from your paycheck before taxes. To determine your total gross wages earned for the year factor in.

Its advantageous to pre-tax benefits when savings on current taxes is needed. StateLocal Tax Rate Percentage to estimate your combined state and local income tax rate. Therefore you pay 5040 biweekly in Social Security tax.

This type of plan is also called a. For 2022 the standard mileage rate is 585 cents per mile. Refer to the employees Form W-4 and the IRS tax tables for that year to calculate and deduct federal income tax.

If you do not have a cafeteria plan the entire 1200 is subject to Social Security tax. If pretax deductions are not included in taxable wages subtract the benefit from gross wages before calculating state or local income tax according to the agencys criteria. Please note that any principal amount is not eligible for tax deduction.

Peter contributes 5 005 per pay period to a pre-tax 401 k plan. You will withhold 25 from Peters wages. You can use the cents-per-mile rule if either of the following requirements is met.

Post-tax contributions for benefits do not reduce overall tax. Since your insurance plan isnt taxable your employer does not include your premiums on your W-2. A pre-tax benefit plan is an account which you sign up for through your employer and fund through payroll deductions.

First and of utmost importance is that before-tax deductions in fact reduce taxes. Income tax is calculated using the individual income tax rates Low Income Tax Offset and Low and Middle Income Tax Offset plus Medicare levy effective from 1 July 2021. Withhold 765 of adjusted gross pay for Medicare tax and Social Security tax up to the wage limit.

This amount must be included in the employees wages or reimbursed by the employee. Pretax Income 8000000 560000 86000 12000 240000 130000 57000 0. Instead of selling goods.

If you contribute a portion of your salary on a dollar. Adjust gross pay by withholding pre-tax contributions to health insurance 401k retirement plans and other voluntary benefits. Pre-tax deductions are payments toward benefits that are paid directly from an employees paycheck before withholding money for taxes.

This permalink creates a unique url for this online calculator with your saved information. Personal use is any use of the vehicle other than use in your trade or business. Visual of a Pre-tax health benefit account reflecting the 3000 of qualified pre-tax expenses and a corresponding 300 to 1000 in tax savings.

Pre-EMI is only the interest paid during the period. 1000 50 950. This entry is optional.

Benefits of Pre-tax Deductions. When you begin payroll withholdings you will first withhold the 401 k contribution because it is pre-tax. The employees taxable income is 950 for the pay period.

Note that the tax calculations are based on your overall tax rate. Health Insurance Taxable Benefit. On completion of the construction the total pre-EMI interest paid in the subsequent years is deductible in 5 equal instalments.

How much can pre-tax contributions reduce your taxes. The deduction is 50 per payroll and you pay the employee a gross pay of 1000 per biweekly pay period. Pre-Tax Financial Income.

Pre-tax contributions reduce overall taxable income and provide an immediate tax-break for employees. Using the formula above the pretax income of Company ABC is calculated as. For example you earn 1200 biweekly.

500 x 005 25. Pre-tax deductions and post-tax deductions. Pretax insurance benefits offered under a Section 125 cafeteria plan arent taxable so theyre taken out of your gross wages before taxes are deducted.

Your annual W-2 includes your taxable wages for the year. Contribution Rate Percentage of your salary youre currently contributing to your plan account. Say you have an employee with a pre-tax deduction.

Federal Income Tax Rate Choose from the dropdown list. However with pre-tax contributions taxes could be owed down the road when the benefits are used.

Excel Formula Income Tax Bracket Calculation Exceljet

A Us Guide To Net Pay And How To Calculate It Standard Deduction Tax Deductions Calculator

Withdrawals Of Pre Tax Money Including Contributions Employer Match Profit Sharing And Rollovers In A Workplace Retirement Benefits Tax Money Contribution

Effective Tax Rate Formula Calculator Excel Template

How To Calculate The Value Of Your Pension Pensions Funny Vintage Ads The Value

More Top Irs Audit Triggers To Avoid Infographic Irs Audit

Network Marketing Tax Benefits Google Search Direct Sales Business Business Tax Tax Deductions

Earnings Before Tax Ebt What This Accounting Figure Really Means

Interest Tax Shield Formula And Excel Calculator

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Interest Tax Shield Formula And Excel Calculator

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

Pretax Income Definition Formula And Example Significance

After Tax Uk Salary Tax Calculator

A Visual Guide To Employee Ownership Employee Stock Ownership Plan Business Leadership Infographic

Profit Before Tax Formula Examples How To Calculate Pbt

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

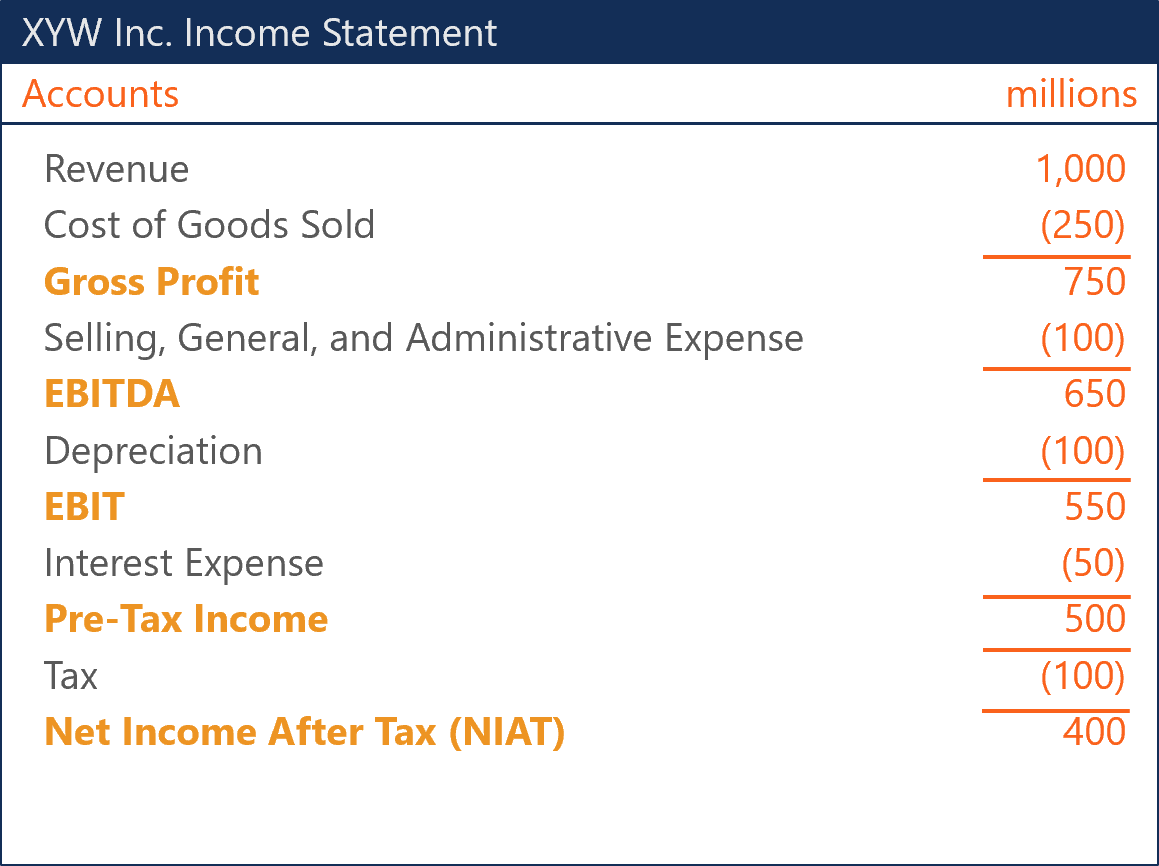

Net Income After Tax Niat Overview How To Calculate Analysis